With the pressing need for countries to transition to net-zero emissions, Australia is outlining its ambitions to become a frontrunner in low-emissions technology through the release of its updated National Hydrogen Strategy. Federal Climate Change and Energy Minister Chris Bowen unveiled this pivotal document, signaling a commitment to establishing a robust green hydrogen industry at competitive costs while fostering investment and showcasing Australia’s aspirations on the global stage.

The Evolution of Australia’s Hydrogen Strategy

The newly released strategy serves as a significant update to the original framework developed in 2019, which laid the groundwork for Australia’s hydrogen ambitions. This updated version is crucial for adapting to the new economic and environmental landscape, demonstrating a clear understanding of the challenges ahead. While it incorporates fresh insights and recommendations, it also illuminates persistent questions regarding its integration with existing policies and the potential use of taxpayer money for hydrogen ventures that may lack viability.

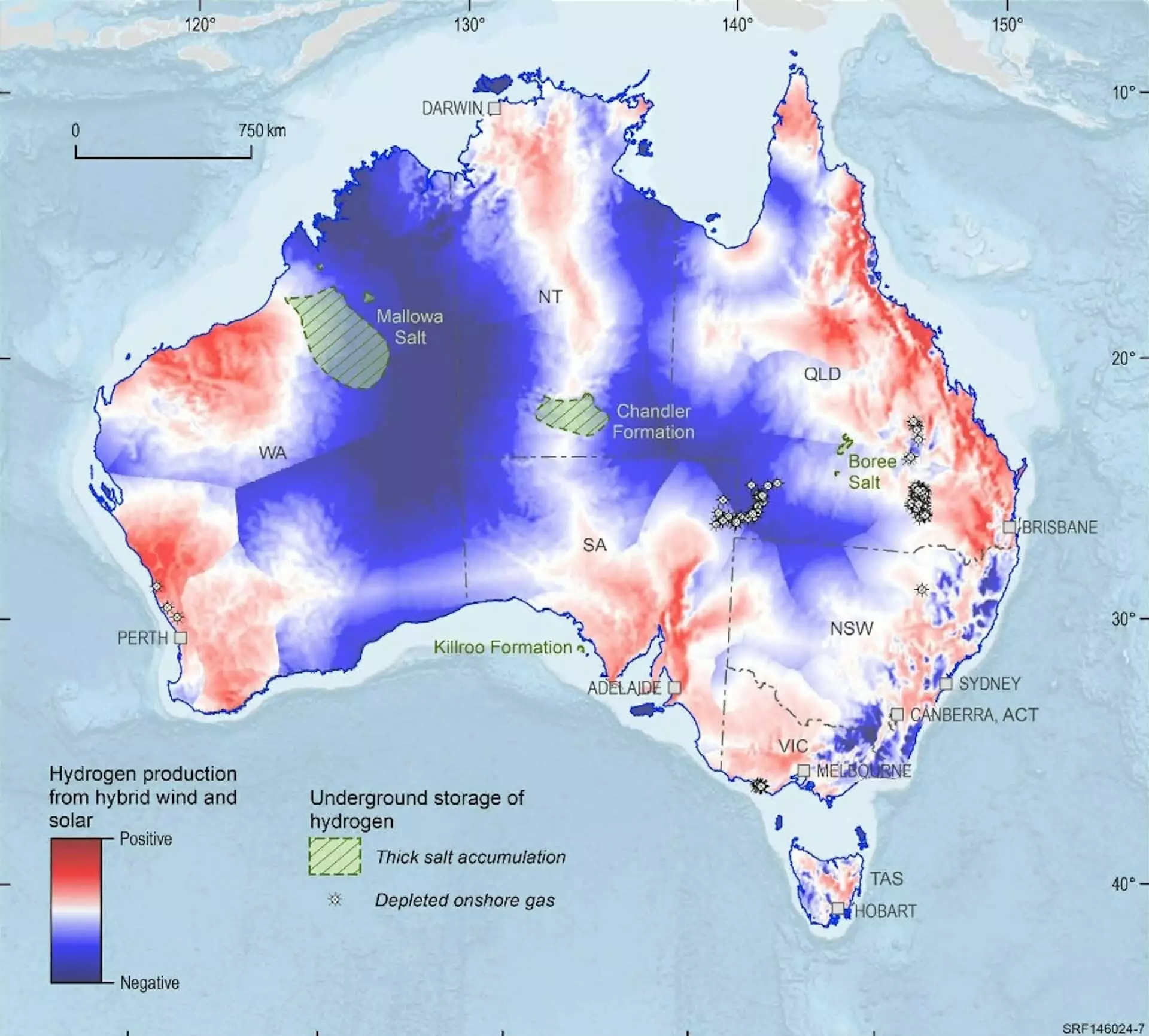

Hydrogen stands as the most abundant and lightest element in the universe, typically found in gaseous forms or bound to other substances. Its applications span from producing fertilizers and plastics to potentially replacing fossil fuels in critical industries such as steel and chemical manufacturing. Furthermore, hydrogen shows promise as a means to store electricity, a resource Australia could harness to stabilize domestic energy supplies or export to nations with less access to renewable energy resources.

Australia’s current hydrogen production primarily relies on natural gas methods, which contribute to greenhouse gas emissions. In light of this, the strategy emphasizes the transition to “green” hydrogen—produced via renewable energy sources that split water without generating emissions. However, this transformation faces notable obstacles, particularly in achieving cost competitiveness. The strategy’s target is to scale up production significantly: producing 500,000 metric tons of green hydrogen annually by 2030, escalating to an ambitious 15 million metric tons by 2050. Stretch targets further project production of 1.5 million and 30 million metric tons by the same respective years.

Despite these ambitious goals, previous targets set under earlier governments, such as achieving a production cost of less than $2 per kilogram, have been revisited in light of their impracticality when accounting for hydrogen’s logistics and storage challenges. Realistic production and pricing goals are essential, yet success hinges on broader governmental policy decisions and the ability to identify and cultivate new markets for hydrogen.

Identifying Key Industries for Hydrogen Utilization

The updated strategy identifies several key sectors where hydrogen may serve as an indispensable resource for reducing emissions. Industries such as iron, alumina, and ammonia are spotlighted, along with promising applications in shipping, electricity storage, and freight transport. Such targeted prioritization indicates a growing recognition of hydrogen’s limitations; for instance, in passenger vehicles, hydrogen technology has struggled to compete against the surge of electric vehicles.

Nevertheless, questions linger about the execution of these priorities. How will the government allocate funding and infrastructure support? Will specific sectors receive priority, and what criteria will determine the viability of funding hydrogen projects? Without assured guidance, potential investors may hesitate to channel their resources into hydrogen initiatives, leading to a stunted industry.

Shifting Market Dynamics: Export Opportunities and Community Engagement

The goals of Australia’s hydrogen strategy have shifted focus from exporting primarily to markets in Japan and South Korea to now include significant European buyers. For instance, the recently announced A$660 million collaborative deal between Australia and Germany underscores Europe’s growing interest in Australian green hydrogen. Yet, the inherent complexities of hydrogen transportation and storage still pose considerable challenges that could hinder export prospects.

The new strategy also addresses community engagement, particularly the importance of public safety concerning hydrogen’s volatile nature. Past experiences have raised concerns about explosion risks, and the revised strategy emphasizes community advantages such as job creation and fostering diverse regional economies. Such efforts include consultations with First Nations peoples and addressing environmental impacts, especially concerning water resources.

Furthermore, the strategy aligns with the Albanese government’s recent initiatives to bolster the hydrogen sector, including the $2 billion Hydrogen Headstart grants program and tax credits for hydrogen producers. While these subsidies aim to stimulate growth, their long-term effectiveness hinges on careful calibration to ensure they do not inadvertently support uninspired technologies that fail to provide sustainable outcomes.

The National Hydrogen Strategy is set for review in 2029, with pivotal markers to gauge its success, such as large-scale project financing, contract signings with suppliers, and commitments from heavy industry to adopt hydrogen solutions in replacing fossil fuels. These indicators will be crucial for assessing whether Australia can reach its ambitious production and export goals.

Ultimately, if progress toward these targets falters over the next decade, a reevaluation of the hydrogen strategy—and perhaps even Australia’s broader ambitions—may become crucial. In navigating these complexities, Australia must remain both adaptable and responsive to the evolving landscape of hydrogen technology and the global market, ensuring it is well-positioned to become a leader in the push for sustainable energy solutions.

Leave a Reply